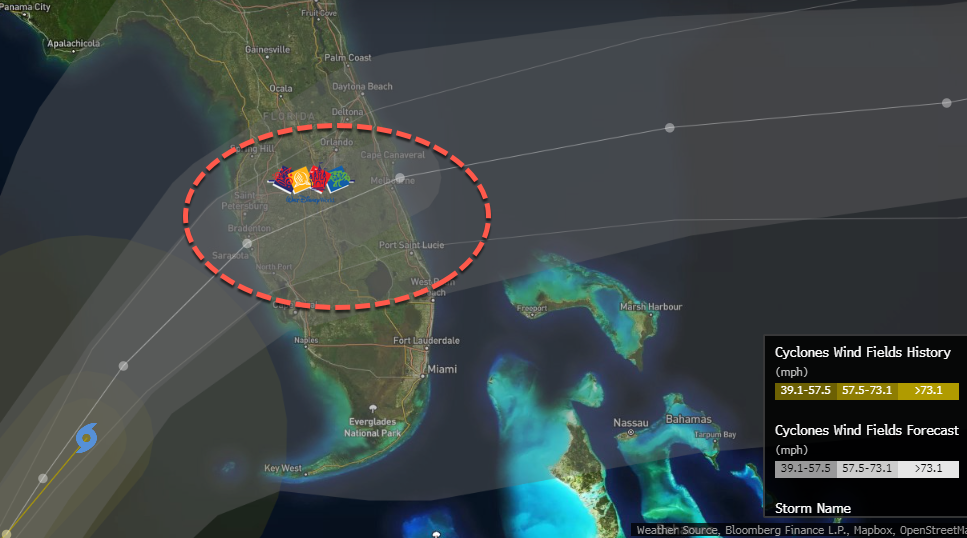

Walt Disney World Resort is in Hurricane Milton’s forecasted path. Analysts from Goldman expect closures and disruptions from the storm could cost the entertainment company between $150 million and $200 million this quarter.

Milton is expected to make landfall in Central Florida late Wednseday night or early Thursday as a powerful Cat. 4 hurricane. Disney shuttered park operations today, and all parks will remain closed on Thursday.

“Specifically, we estimate a $150 mn – $200 mn adverse impact to F1Q25E Parks & Experiences EBIT driven by a 4 pp adverse impact to domestic attendance growth in F1Q25E based on historical headwinds from hurricanes due to closure and disruption times. For instance, Hurricane Irma in 2017 was a $100 mn headwind to DIS EBIT and a 3 pp headwind to domestic parks attendance with 2 days of closure at Walt Disney World and some cruise ship itinerary disruptions,” the team of Goldman analysts led by Michael Ng and Shelby Spencer wrote in a note to clients on Tuesday.

Ng and Spencer said their F4Q24E estimates (published 9/24/2024) remain unchanged and forecast Disney to deliver F4Q24E EPS of $1.16 (v. Visible Alpha Consensus Data of $1.10) and segment OI of $3.8 bn (in-line with consensus). However, they reduced their F1Q25E Parks and Experience EBIT from the estimated hurricane impact, pushing down the F2025E EPS estimate to $5.14 (v. $5.22 prior and $5.13 consensus), adding, “Our F2026/27 EPS are essentially unchanged on average at $5.96/$7.10.”

They note prior storms, including Hurricanes Ian (F4Q22), Dorian (F4Q19), Irma (F4Q17) and Matthew (F1Q17), forced Disney to shutter resorts for 1-2 days on average.